Android tablets

Stay up to date with the latest news, reviews, and buying guides for top Android tablets in a variety of sizes and specifications.

Reviews

The best

Guides

Buyer's guides

Features

How-to's

All the latest

Android tablets news

Download these eccentric wallpapers for your phone

Edgar Cervantes22 hours ago

How to hard reset an Amazon Fire tablet

Edgar CervantesApril 21, 2024

What's the best cheap Android tablet? Here are our top 8

Ryan HainesApril 21, 2024

Samsung Galaxy Tab S9 series is here: Price, specs, availability, and more

Adamya SharmaApril 17, 2024

Samsung Galaxy Tab S9 vs Google Pixel Tablet: Which tablet should you buy?

Calvin WankhedeApril 16, 2024

How to turn your Amazon Fire tablet into a smart home control hub

Edgar CervantesApril 14, 2024

Samsung Galaxy Tab S9 Plus review: Should you buy it?

Ryan HainesApril 6, 2024

Samsung Galaxy Tab A7 Lite review: Lite on the money

Curtis JoeApril 4, 2024

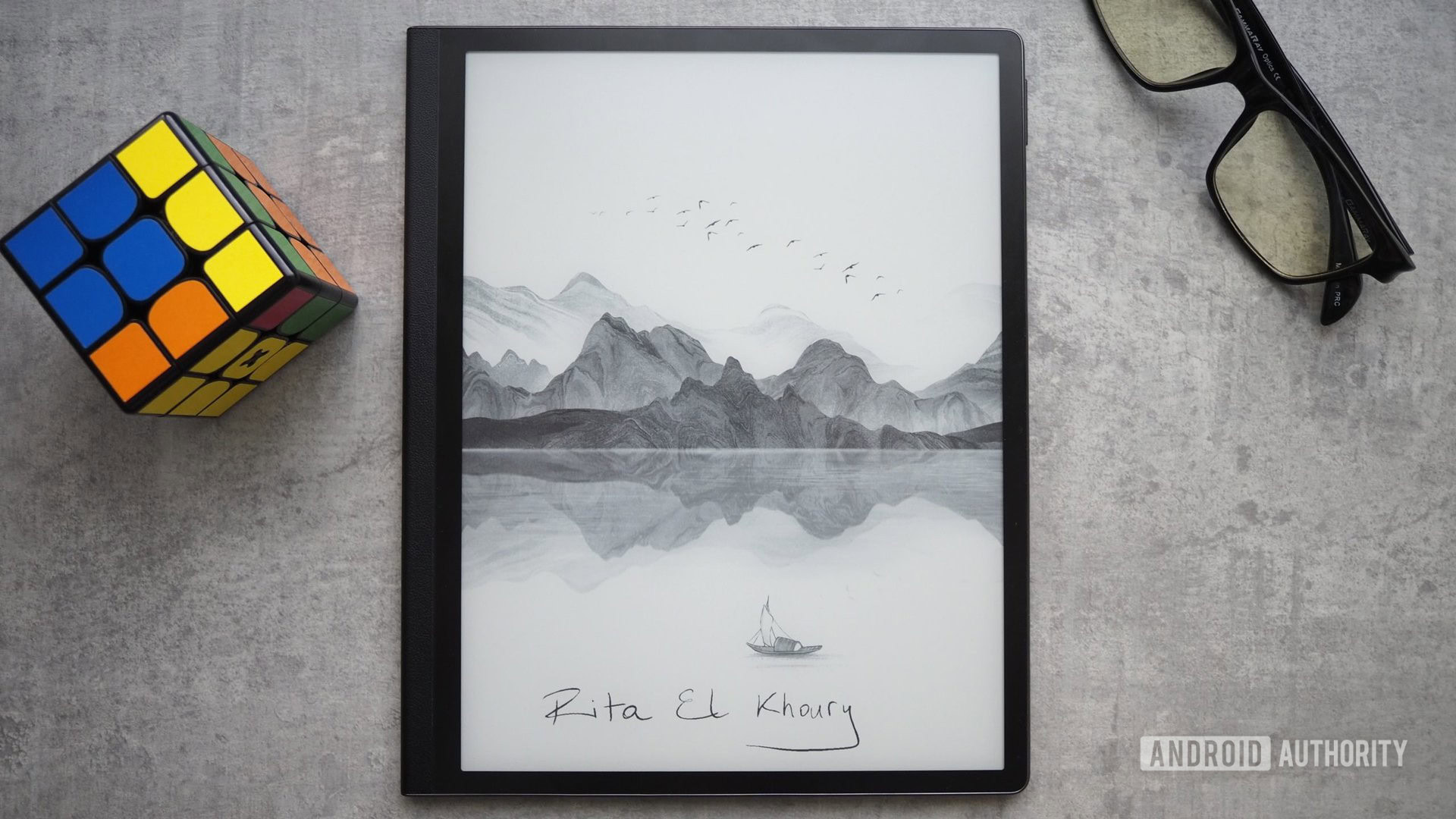

The best E-Ink tablets: Do more than reading!

Edgar CervantesMarch 27, 2024

The 7 best apps for the Samsung Galaxy Tab S9

Matt HorneMarch 27, 2024

Dock-free Pixel Tablet spotted in European listings, official pen and keyboard coming too

Rushil AgrawalApril 25, 2024

Rare Galaxy Tab Active 4 Pro deal slashes price by $169

Matt HorneApril 25, 2024

Google might be letting loose its own Pixel tablet with a pen and keyboard

Rushil AgrawalApril 24, 2024

OnePlus Watch 2 Nordic Blue Edition makes better use of that big bezel

Aamir SiddiquiApril 23, 2024

The Samsung Galaxy Tab A9 Plus drops in price again — now just $159.99

Matt HorneApril 17, 2024

The latest OnePlus Pad 2 leak hints at a powerful upgrade

Rushil AgrawalApril 16, 2024

The OnePlus Pad 2 launch window may have just leaked

Hadlee SimonsApril 15, 2024

The 2024 Galaxy Tab S6 Lite comes with a $100 Amazon Gift Card

Matt HorneApril 11, 2024

Samsung Galaxy Tab S8 slashed by 40%

Matt HorneApril 10, 2024

This Harry Potter special edition phone and tablet are an absolute treat for fans

Aamir SiddiquiApril 9, 2024